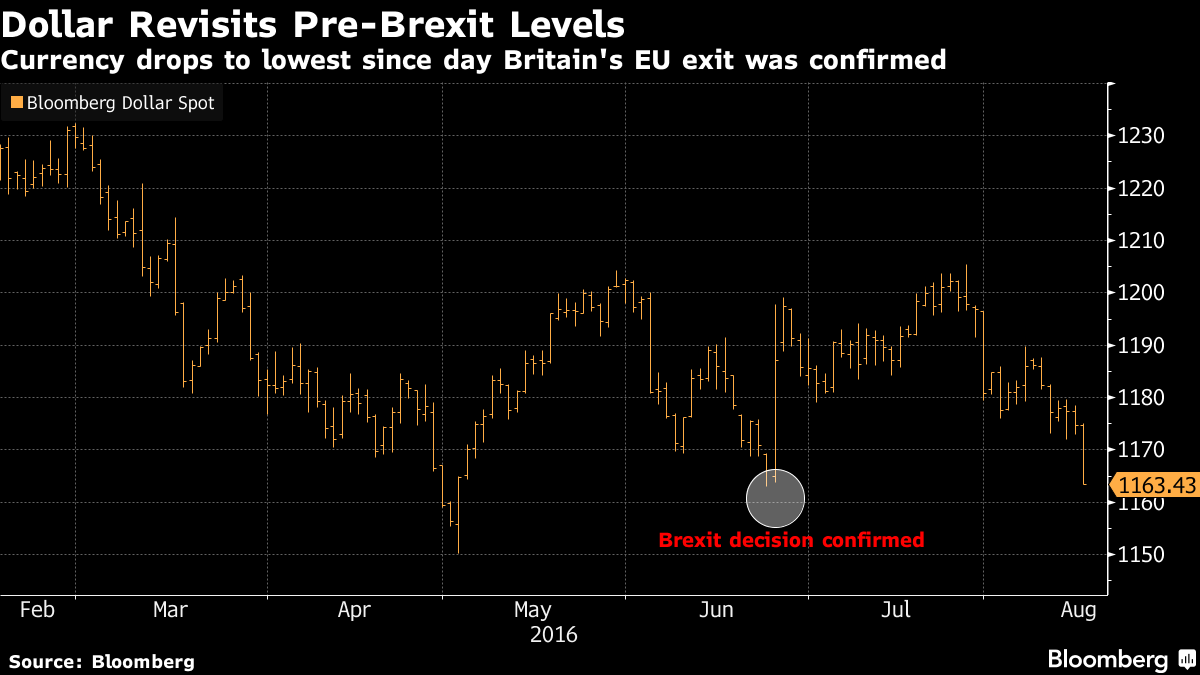

The dollar’s slide is gathering pace and that’s proving as much a boon for emerging markets and commodities as it is a drag for European equities. The Bloomberg Dollar Spot Index sank to its weakest since June before reports on housing starts, inflation and industrial output that may add to signs growth in the world’s largest economy is losing momentum. Emerging-market currencies reached the strongest in more than a year and stocks from those nations gained for a ninth day. The pound jumped as U.K. inflation accelerated in July more than economists predicted, and the yen strengthened through 100 per dollar. Precious metals advanced with Treasuries.

Igor Purlantov is an expert on business and politics across emerging markets. Mr. Purlantov has worked extensively in various emerging countries throughout Europe, Asia and Africa with both public and private companies as well as local governments. You can read and learn more about his work on www.igor-purlantov.net

Tuesday, August 16, 2016

Wednesday, August 10, 2016

Emerging Markets Gaining Favor Despite China Concerns

The hunt for yield is driving investors back into emerging markets – but there are a few key differences this time round. Emerging market equities, measured by the MSCI Emerging Markets Index, are now 30 percent up from the low seen at the end of January, and have rallied by 13 percent since the post-Brexit referendum sell-off. Plus, in the past five weeks, record amounts of money have been invested in emerging market debt, according to figures from Bank of America Merrill Lynch.

http://tinyurl.com/j849xoj

Subscribe to:

Posts (Atom)