Already battered emerging markets stocks and currencies may face the specter of further outflows, but some analysts are tipping they've become the Mystery Science Theater 3000 of assets: So bad they're good. In emerging markets, "you don't have earnings growth, ROEs (return on equity) are continuing to decay (and) forex volatility is against you. It's not the best of pictures," Bhaskar Laxminarayan, Pictet Wealth Management chief investment officer for Asia, said at a press conference last week.

Igor Purlantov is an expert on business and politics across emerging markets. Mr. Purlantov has worked extensively in various emerging countries throughout Europe, Asia and Africa with both public and private companies as well as local governments. You can read and learn more about his work on www.igor-purlantov.net

Monday, December 14, 2015

Monday, December 7, 2015

U.S. Rate Hikes Could Hurt Emerging Markets

Emerging markets are at risk of negative fallout from an eventual rise in U.S. interest rates despite more settled conditions in financial markets in the fourth quarter, the Bank for International Settlements said Sunday. "The calm has been uneasy," said BIS economics department head Claudio Borio. "Very much in evidence, once more, has been the perennial contrast between the hectic rhythm of markets and the slow motion of the deeper economic forces that really matter."

http://tinyurl.com/jp7zcvlMonday, November 30, 2015

Four Picks From an Emerging Markets Pro

Ask Jean-Louis Scandella which emerging market countries he likes, and he nearly gets angry. Macroeconomic punditry and “top down” country approaches are plentiful, as the developing world braces for the Federal Reserve’s first interest-rate hike in years. But individual stocks are what matter to Scandella, head of equities at Baring Asset Management and co-manager of its emerging market portfolio strategy. He looks for growing companies, and is willing to pay a premium for them because there are few “sleeping beauties.”

Monday, November 23, 2015

Emerging Markets Retreat From Abyss

Finally, there may be some relief for emerging-market investors. Strategists at banks from Goldman Sachs Group Inc. to Bank of America Corp. say that developing-nation assets are bottoming out following three years of losses in currencies and stocks. It’s not that they are likely to embark on a rally. Rather, that the mood among investors has become so depressed, even a marginal improvement in the economic outlook will be enough to shift sentiment and drive up assets such as the Mexican peso, Russian ruble bonds and Indian stocks, the analysts say.

Monday, November 16, 2015

Funds Mull Best Way to Get Emerging Markets Exposure

While money managers continue to grapple with trying to pinpoint the right time to add to emerging markets allocations, institutional investors also are bombarding them with questions about the right way to gain exposure. Sources said pension fund allocations to emerging markets remain low relative to the percentage of world GDP these countries represent, and some institutional investors still have no exposure. The Institute of International Finance said in its April 2015 Trends in Investment Fund Portfolio Allocation report that about 13% of investors' equities and bonds portfolios were allocated to emerging markets.

http://tinyurl.com/q7dfxuu

Monday, November 9, 2015

Emerging Markets a Mess, Need a 'Country by Country' Look

The rout in global commodities prices has claimed a number of formerly high-flying developing economies — and their asset markets — as victims. Despite the widespread carnage, there are still some regions that may be relatively attractive to investors.

http://tinyurl.com/oujgvwy

http://tinyurl.com/oujgvwy

Monday, November 2, 2015

How Some Emerging-Market Investors Actually Made Money

In a rough year for emerging markets, some of the most treacherous trades are paying off. Bonds issued by Latin American oil companies, Ukrainian banks and Chinese real-estate developers are among the best-performing assets in developing economies in 2015. Fund managers who snapped up these battered bonds—and other assets deemed risky even by the standards of emerging-market investors—are delivering positive returns while benchmarks languish in negative territory.

Monday, October 26, 2015

China Rate Cut Lifts Emerging Markets

Most emerging-market stocks rose as China’s surprise interest-rate cut added momentum to a four-week rally in riskier assets. The zloty weakened and Polish banking stocks fell after the opposition party looked poised for an election victory. The Shanghai Composite Index climbed 0.5 percent in the first trading day after China lowered borrowing costs for the sixth time in a year and reduced lenders’ reserve requirements.

Monday, October 19, 2015

A Good Acronym for Emerging Markets Needs a V

Rarely has there ever been an acronym more fortunate than the BRIC group. Starting in 2001, when Jim O'Neil from Goldman Sachs synthesized Brazil, Russia, India and China, followed later by South Africa, the term began appearing in economics publications and everyday language. Soon it became synonymous with emerging markets, a relentlessly growing web that threatened to undermine the industrial world's primacy.

http://tinyurl.com/o3yqzt4

Monday, October 12, 2015

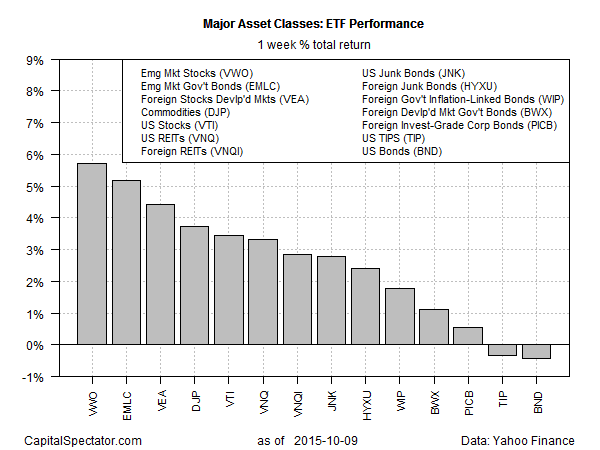

Will Last Week's Relief Rally In Emerging Markets Last?

Stocks in emerging markets posted their best weekly gain in nearly four years last week. Analysts are divided over whether this is a dead-cat bounce or the start of an enduring mean-reversion trade in the wake of nearly non-stop declines since last April. From the perspective of the week just passed, however, there's no doubt that equity markets in so-called emerging countries enjoyed a powerful rally for the five days of trading through Oct. 9.

http://tinyurl.com/obge53w

http://tinyurl.com/obge53w

Monday, October 5, 2015

New Emerging-Market Woes

One of the last havens in emerging markets is showing signs of strain. Companies in emerging markets issued trillions of dollars of foreign-currency bonds during the decade long commodity boom, and took advantage of low interest rates in the developed world following the 2008 financial crisis. Now, many investors fear the commodity bust will lead to a rise in defaults that could deepen economic slumps in many of these nations. Until a few months ago, emerging-market corporate bonds were regarded as a haven amid the routs that had hit stocks and currencies in many developing countries because the bonds are typically issued in the U.S. dollar and by companies with robust growth and credit profiles.

http://tinyurl.com/nbyls7e

Monday, September 28, 2015

Turmoil in Emerging Markets Tests Resilience of US and Europe

The most important question confronting investors is whether the United States and Europe will remain insulated from the economic turmoil that is now sweeping through the emerging markets. Janet Yellen, who chairs the US Federal Reserve, is confident that the prospects for the world's largest economy "appear solid", clearing the way for an interest rate rise by the end of the year.In a speech last Thursday, Dr Yellen acknowledged that the Fed was keeping a close eye on what she described as "developments abroad", before adding that that "we do not currently anticipate that the effects of these recent developments on the US economy will prove to be large enough to have a significant effect on the path for policy".

http://tinyurl.com/ntno6dj

Monday, September 21, 2015

Smarter Way to Play an Emerging Market Rebound

Emerging market funds – targeting shares in fast-growing Asian and South American countries – have delivered losses averaging 12pc over the past three years. Much of the damage occurred in recent months as anxiety about the strength of economic growth rocked the markets. An upward move in US interest rates – which did not materialise last week, but will eventually arrive – is expected to knock these regions further. Heavy commodity price falls, which have also depressed emerging market currencies, show no sign of reversing.

http://tinyurl.com/ptcbrmb

http://tinyurl.com/ptcbrmb

Monday, September 14, 2015

Bargains in Emerging Markets Can Be Risky

As emerging markets reel from their worst selloff in years, some investors are picking through the ruins, convinced that the massive slide in stocks and bonds has uncovered rare opportunities to buy on the cheap. Their shopping list includes Mexican bonds, Philippine banks and Chinese Internet companies. The key, they say, is to be selective—while bargains abound, many believe that emerging markets remain fraught with peril.

Tuesday, September 8, 2015

China and Emerging Markets Capital Crisis That Wasn’t

New figures from China’s central bank point to large, but not crippling, outflows The end-of-summer meltdown in emerging markets, when the MSCI stock benchmark collapsed by 9% in August, created a bigger fear than just stock losses—chiefly that emerging countries are experiencing crippling capital outflows.

http://tinyurl.com/os7n67zMonday, August 31, 2015

Emerging Markets Offer Growth Opportunties

As defense budgets face downward pressure in the US and Europe, emerging markets are poised to spend more than a trillion dollars on defense over the coming decade, creating business opportunities for Western defense firms.A recent Frost & Sullivan analysis of 10 emerging markets concluded that between 2015 and 2025, emerging markets in Southeast Asia, South America, the Middle East and elsewhere would spend more than $1.2 trillion on defense. Over that period, military expenditures in Colombia, Kuwait, Malaysia, Morocco and Singapore are expected to see 3.6 percent compound annual growth rate, while Angola, Azerbaijan, Peru, Qatar and South Korea can anticipate a CAGR of 2.8 percent.

http://tinyurl.com/p4r4aya

http://tinyurl.com/p4r4aya

Labels:

angola,

azerbaijan,

colomobia,

defense budgets,

emerging markets offer growth opportunities,

growth rate,

igor p purlantov,

kuwait,

middle east,

peru,

south america,

us and europe

Monday, August 24, 2015

Emerging Market Turmoil Isn't Too Bad

Emerging markets are in free fall. Currencies are reeling, stocks are tanking and commodities are sinking, evoking memories for many investors of the financial crisis that hit Asia hard in 1997 and 1998. Concerns over a slowdown in China have dented confidence, while investors have also fretted over the impact on emerging markets of an imminent increase in interest rates by the U.S. Fed.

Wednesday, August 19, 2015

Got China? Two Big Emerging Market ETFs

The two leading exchange-traded funds focusing on emerging markets have very different exposure to now-vulnerable Chinese stocks and will probably diverge further, a new analysis by S&P Capital IQ shows.The Vanguard FTSE Emerging Markets Stock Index ETF recently had 28 percent of its assets invested in China, while Blackrock Inc's iShares MSCI Emerging Markets ETF had 24 percent, even though both are index-following broad emerging markets funds. Chinese stocks fell 6 percent on Tuesday, and further weakness in both that market and China's economy could play out very differently in these two funds.

Monday, August 10, 2015

Investors Should Stick With Emerging Markets

These are strange times in the investment world and indeed the whole global economy, when many of the certainties that have driven stock and bond prices over the past decade and more appear to have been thrown out of the window. On this side of the world, we are seeing vast sums flowing into European markets, particularly fixed income. As I write, the five-year German bund is yielding a whole 0.07pc, hardly the type of return that you could build a pension pot on.

Monday, August 3, 2015

Heineken Boosted by Emerging Markets

Heineken NV, the world’s third-largest brewer by sales, on Monday reported a rise in profit and revenue as the Dutch beer maker benefited from robust sales in emerging markets and strong demand for its premium brands. Net profit was €1.14 billion ($1.25 billion) in the first six months of 2015, up 88% from the €631 million it reported a year earlier. Consolidated revenue rose 7% to €9.9 billion from €9.3 billion.

http://tinyurl.com/pten7wvMonday, July 27, 2015

Video: Tread Carefully in Emerging Markets

GAM Investment Director Paul McNamara discusses the commodities rout

and its impact on global markets. He speaks with Bloomberg’s Caroline

Hyde on “Countdown.”

Monday, July 20, 2015

What Growth in Emerging Markets Means for E-Commerce

When considering how to get ahead as an e-commerce business within an increasingly saturated market, the first logical notion that comes to mind is to target a market that holds the greatest potential for growth. Considering that e-commerce is wholly dependent on Internet users, the continuing rise of Internet access in emerging markets situates it as a mecca for both present and future e-commerce activity.

http://tinyurl.com/npmdwmo

http://tinyurl.com/npmdwmo

Monday, July 13, 2015

Bold Call: Buy Emerging Markets Now

With turmoil in China and Greece, emerging markets may look like a risky bet. But according to one technical analyst, this is the perfect time to buy into those global stocks. "Over the past six years, emerging markets have done absolutely nothing. But there's been one way to make money," said Evercore ISI's head of technical analysis, Rich Ross. The key, he said, has been to buy emerging markets on the lows, sell on the highs and repeat.

http://tinyurl.com/qj8dqglMonday, July 6, 2015

Why Africa and Emerging Markets Need Crowdfunding

Whenever I tell someone about Fundz, they always ask me, where did a guy like you come up with the idea of creating a crowdfunding platform for emerging markets? The fact is, I have always been interested in emerging markets. About 15 years ago I was on a trip to eastern Ghana. We lived in mud dwellings and took bucket baths for four weeks. I was in this village that had no connection to the outside world, but what was interesting was that beneath their disconnectedness they yearned for connection They couldn’t afford electricity, but they spliced into the main line running through the village. They had a local entrepreneur who brought in malt, Coca Cola, and other products. The people of this village wanted to travel, to grow, and build. It is the human condition.

http://tinyurl.com/pjso83mMonday, June 29, 2015

Preparing for the Coming Emerging Markets Rally

A rising number of strategists and asset managers predict that emerging markets will outperform in the next few years. But how much money should an investor allocate to this volatile group, and how best to participate? A good starting point is emerging markets’ portion of the world’s equity capitalization—about 13%. But because investors tend to have a home-country bias that prevents them from venturing too far abroad and some markets have lost value owing to falling currencies, the 13% figure may be on the low side, particularly when you consider some of the new or expanding members of the market.

Monday, June 22, 2015

East Europe Benefits From Greek Deal Hopes

Signs of a last-minute deal to prevent a Greek default propelled emerging stocks to their biggest one-day rise in more than two months and the relief also lifted emerging currencies, especially in eastern Europe. MSCI's emerging equity index rose 1 percent, pulling off 2-1/2 month lows hit last week when Athens appeared headed towards default and a euro exit just as the U.S. Federal Reserve is preparing for its first rate rise in almost a decade. The Athens market jumped more than 8 percent as euro zone officials said Greece's reform proposals were "reasonable".

http://tinyurl.com/ow3v6l9Monday, June 15, 2015

For Emerging-Market Traders, Trend Is Their Friend

It used to be that a four- or five-day rally in emerging-market stocks was a big deal. Not anymore. Nowadays, if the stretch of gains, or losses, doesn’t reach double digits, it almost feels inconsequential. Consider these runs: The MSCI Emerging Markets Index fell for 12 straight days from late May through early June, the longest streak since 1990; less than two months earlier, the gauge rose for 11 consecutive sessions, the longest rally since 2005. In the past six months alone, there have also been moves of eight and nine straight days.

http://tinyurl.com/pzhusnh

Monday, June 8, 2015

Europe Has Different Attitude About Coal From Emerging Markets Like China

Companies, banks, and investment funds, primarily European, have been coming out in recent weeks with announcements they will halt investments in coal, a new front in efforts to reduce use of the highly polluting fuel that faces a battle against the hunger for power in emerging markets. The latest move came Friday, when Norway's parliament voted to force its sovereign wealth fund — the world's biggest — to pull out of firms that are heavily involved with coal. Earlier in the week, French energy-group Total announced it would withdraw from its coal activities, notably in South Africa where it is involved in the production and sale of the fuel that is important for electricity in numerous countries around the world.

http://tinyurl.com/qy98fle

Monday, June 1, 2015

A Concentrated Bet on Emerging Markets

Fund managers who invest in emerging markets have thousands of stocks to choose from, in more than 20 countries across Europe, Asia, Africa and Central and South America. But some of the largest emerging-market funds hold 100 stocks or fewer. Among them: the $14.5 billion Lazard Emerging Markets Equity fund, which recently held 78 stocks; the $11 billion Virtus Emerging Markets Opportunities fund, with 74 stocks; and the $10 billion Aberdeen Emerging Markets fund, with 64.

http://tinyurl.com/q3a4afqTuesday, May 26, 2015

Samsung’s Smartphones Could Have Potential In Emerging Markets

Samsung’s Tizen mobile platform is all too easy to write off as a failure. The product, which is a Samsung-owned rival to Google’s Android and Apple’s iOS operating systems, was delayed for more than a year. Even when the first Tizen-powered device finally emerged this January, it was a pretty underwhelming $92 smartphone for India and other emerging markets. Added to that, Samsung had earlier extended the platform to cover smart TVs, a move that some took to mean that the platform wouldn’t have a major role in its mobile division.

http://tinyurl.com/mvbpomnMonday, May 18, 2015

Cornell Professor Wants You To Get Over The 'BRICs'

Andrew Karolyi, a finance professor at Cornell University and an expert in investment management, wants to get over the idea of the BRICS. He says that isolating countries into rich/poor categories with cute acronyms is unhealthy – not only for those countries, but also for investors who might overlook great opportunities based on a name.

http://tinyurl.com/l4qgotmMonday, May 11, 2015

Best Emerging Market Countries To Invest In Now

Credit Suisse upgraded its outlook on emerging markets and recommended investors overweight India, South Korea and Taiwan in a mammoth 92-page “Global Equity Strategy” report released Wednesday. The largest exchange traded funds on the stock market providing exposure to the stock markets in these countries are iShares MSCI India (INDA), iShares MSCI South Korea Capped (EWY), iShares MSCI Taiwan (EWT).

http://tinyurl.com/phmb3wx

http://tinyurl.com/phmb3wx

Monday, May 4, 2015

Emerging Markets Rally, for Now

At the start of the year, the accepted strategy for investing in emerging markets could be summed up in one word—don’t. But developing-country stocks have surged nearly 13% in the past eight weeks, largely because the demon that was stalking them, the arrival of higher U.S. interest rates, has likely been pushed back. Currencies and bonds have also rallied, giving some countries and businesses a much-needed chance to clean up their books to prepare for higher rates. The reprieve is temporary.

Monday, April 27, 2015

Emerging Markets Are Hot

After a horrid collapse late last year, emerging market stocks have come roaring back in 2015. Not without considerable basebuilding, however. Several emerging market exchange-traded funds spent the last six months churning in head-and-shoulder bottom formations. The chart for the low-cost leader, the Schwab Emerging Markets Equity ETF (NYSE Arca: SCHE) is typical.

http://tinyurl.com/n2npp66

http://tinyurl.com/n2npp66

Monday, April 20, 2015

Emerging Market Central Banks: Doves Into Hawks

Investors see emerging market central bankers as doves. But they are likely to turn hawkish.

http://tinyurl.com/mrq6xaj

http://tinyurl.com/mrq6xaj

Monday, April 13, 2015

Some Emerging Markets More Promising Than Others

Buy low, sell high. This is the only secret investors need to know. But the big problem right now is trying to get a handle on which assets are actually going cheap. Major western indices have been hitting new records, with even the FTSE 100 coming to the party, despite its heavy weighting to the slumping energy and mining sectors. But worries about “secular stagnation” have clouded the outlook – and investors have been corralled by fear into similar asset classes. Finding investments that are cheap and under-owned is becoming increasingly difficult.

Monday, April 6, 2015

Russia Leads Emerging Markets Higher

Stocks in developing economies were a pretty good place to be in the first quarter. The MSCI Emerging Markets Index rose 1.9%–reflecting price returns converted to dollars–in the first quarter, while the Standard & Poor’s 500 index was up 0.4%. The devil was in the details. Latin America, off 10%, was down for the count in the latest quarter. Eastern Europe was a surprise winner, with a gain of 11%, powered by Russian and Hungarian equities. Asia showed strength, too (up 5%), though for all the hype about India’s gross-domestic-product growth surpassing that of China, the latter’s stocks shone brighter in the latest quarter.

http://tinyurl.com/m9uhxhfMonday, March 30, 2015

Emerging Stocks Cheer As China Shares Hit Seven Year Highs

Emerging market shares started the week by rising almost 1 percent on Monday, buoyed by Chinese stocks at 7-year highs, though currencies suffered at the hands of a recovering dollar and lower oil prices. MSCI's emerging equity index rose 0.8 percent, lifted by China stocks jumping almost 3 percent on hopes that more infrastructure spending and policy stimulus will re-energise a cooling economy and boost profits.

http://tinyurl.com/qgs8htqMonday, March 23, 2015

Mobius Seeks Emerging Markets Growth in Japan

Looking to invest in emerging markets? Consider Japan. That’s what emerging markets veteran Mark Mobius is doing. With growth prospects limited at home, Japanese companies are investing more and more in faster-growing countries such as Indonesia, Thailand and India, said Mr. Mobius, executive chairman of Franklin Templeton’s emerging markets group. And the Bank of Japan’s asset-purchase program has weakened the yen against many emerging market currencies, helping Japanese companies who sell products and services there, he noted.

http://tinyurl.com/n23fwduMonday, March 16, 2015

Why India’s Economy Isn’t Imploding Like Others

On Feb. 17, an article appeared in The New York Times, “As Rivals Falter, India’s Economy is Surging Ahead,” by Keith Bradsher, which, among other things, says, “The stock market and rupee are surging. Multinational companies are looking to expand their Indian operations or start new ones. The growth in India’s economy, long a laggard, just matched China’s in recent months…India is riding high on the early success of Prime Minister Narendra Modi and a raft of new business-friendly policies instituted in his first eight months.”

http://tinyurl.com/mpeks9x

http://tinyurl.com/mpeks9x

Monday, March 9, 2015

Is Dollar Losing Clout Among Emerging Markets?

The greenback's dominance in the developing world may be under threat as more emerging economies begin to reduce their reliance on the global trade currency. "Decreasing reliance on the dollar is an important trend that's going to grow," said Jim Rickards, chief global strategist at West Shore Funds. "As far as emerging markets, the rise of bilateral trading deals is significant for the dollar's future as a trade currency." Around 80 percent of global trade finance is conducted in dollars, according to January data from SWIFT.

Monday, March 2, 2015

Low Cost Apps Offer Benefits to Emerging Markets

Emerging markets are fueling growth in the mobile phone market, but for app developers this presents big challenges. Almost 80 per cent of the 1.8bn people expected to acquire handsets in 2018, according to the International Data Corporation, live in areas where network coverage is patchy, budgets are tight and smartphones are relatively rare. App developers need to take into account the smaller screen size and reduced capability of low-cost phones in emerging markets, says India-based Neha Dharia, a senior analyst at Ovum, a telecoms consultancy.

http://tinyurl.com/pk5xf8d

http://tinyurl.com/pk5xf8d

Tuesday, February 24, 2015

The Healthiest Emerging Markets in 2015

With economic growth slowing in China, India is emerging as the fastest-growing member of the BRICs (Brazil-Russia-India-China). The International Money Fund predicts global growth will reach 3.5 percent this year; however, besides India, BRIC economies are taking their financial turmoil from 2014 and bringing it into 2015.

http://tinyurl.com/kzfwed6

http://tinyurl.com/kzfwed6

Monday, February 16, 2015

Google Plans To Sell More Android Phones In Emerging Markets

Google is testing a way to make its super-cheap Android One smartphones more useful and accessible to people in emerging markets. The company wants to partner with developers to make apps cheaper or free to use, a practice called "zero-rating," The Information's Amir Efrati reports, based on discussion with people with knowledge of Google's plan.

http://tinyurl.com/pzenz8c

http://tinyurl.com/pzenz8c

Monday, February 9, 2015

The 2015 Bargain: Emerging Market Stocks

Emerging markets are notorious for being a roller coaster ride of ups and downs. So far this year, the signs are pointing to an upswing. They could very well beat the U.S. this year. Falling oil prices and the strong U.S. dollar were problems for emerging markets in the past. They're overall positives now, experts say.Despite a recent surge, emerging markets still offer a good bang for your buck. The S&P 500 is trading at about 17 times expected earnings. Compare that to the MSCI Emerging Markets Index, which is only trading at 13 times earnings. A popular fund, the iShares MSCI Emerging Markets ETF, is up 6% in the past month alone.

http://tinyurl.com/n8wlt5w

Subscribe to:

Posts (Atom)