Back in October, I highlighted EG Shares’ new emerging market option,

the Beyond BRICs ETF (BBRC). BBRC is the first ETF for emerging markets

that specifically excludes the “BRIC” countries of Brazil, Russia,

China and India. This strategy caught my attention because I’ve never been a big fan

of the BRICs as an investment theme. The countries comprising the BRIC

were chosen more for their ability to be combined into a marketable

acronym than for any coherent investment rationale.

http://tinyurl.com/l2j734s

Igor Purlantov is an expert on business and politics across emerging markets. Mr. Purlantov has worked extensively in various emerging countries throughout Europe, Asia and Africa with both public and private companies as well as local governments. You can read and learn more about his work on www.igor-purlantov.net

Tuesday, December 31, 2013

Monday, December 30, 2013

Emerging Market Stocks Rise on Turkey Rally

Emerging-market stocks advanced, led by the biggest rally in Turkey’s benchmark index in more than three months, amid speculation political tension in the country may ease. The lira strengthened, while Russia’s ruble declined.

http://tinyurl.com/kxdysca

Friday, December 27, 2013

Quiet Bull Calls on Emerging Markets

For much of 2013, being bearish

on emerging markets was the right call. Stocks in developing economies

from the BRIC nations to the ASEAN group to CIVETS and nearly any other

catchy acronym proved to be major disappointments as equities in the

U.S., Japan and some other developed markets soared. Weakening currencies, slumping

commodities demand and current account and fiscal deficits prompted

investors to pull $13.7 billion from emerging markets bond for the year

through December 18, while $6.3 billion has left emerging market equity

funds over the same period, CNBC reports, citing Jefferies data.

http://tinyurl.com/lynp6w8

http://tinyurl.com/lynp6w8

Tuesday, December 24, 2013

Selling More Instant Noodles In Emerging Markets

A boy runs inside an exhibit made to look like a giant up-turned cup noodle pot at the opening of a cup noodle museum in Yokohama, suburban Tokyo, on Sept.17, 2011. After Japan’s traditional cuisine, “washoku,” was recognized by Unesco as an “intangible cultural heritage” earlier this month, some of the nation’s food makers announced plans to fill the bellies of the developing world with something perhaps more tangible. Earlier this week, Toyo Suisan Kaisha Ltd. and Ajinomoto Co. said they would set up joint ventures in India and Nigeria, the world’s 5th and 12th biggest markets for instant noodles, respectively.

Monday, December 23, 2013

Blackberry, Foxconn Deal Aimed at Emerging Markets

BlackBerry announced Friday a third-quarter loss of $4.4 billion, a stunning freefall from the loss of $965 million suffered in the second quarter of this year. Revenue also tumbled, nestling in at $1.2 billion, down from $1.6 billion in the prior quarter. BlackBerry managed to sell only 1.9 million smartphones last quarter, an ugly decline from the 3.7 million sold in the previous quarter. And talk about a vote of no confidence: The company said that "most of the units" that generated revenue were older BlackBerry 7 designs, not the newer BlackBerry 10 devices that had been front and center in its revival efforts.

Friday, December 20, 2013

Emerging Market Stocks Could Escape 'Taper Tantrums'

Emerging market economies might be bracing themselves for the after-shock of the U.S. Federal Reserve's latest policy move, but there are individual stocks that could still take off, an asset manager told CNBC. "Every time there is a big dislocation or big macro consensus trades - and that has been long developed markets, short emerging markets -- and flows are driving valuations, there are always specific stocks or specific opportunities you can take advantage of," Alper Ince, managing director of the Pacific Alternative Asset Management Company, told CNBC on Friday.

Thursday, December 19, 2013

Key Emerging Markets Events in 2014

Frontier Strategy Group put together a report listing five potential

global events to watch among emerging markets for what it refers to as

an “unpredictable” 2014. The research, released Thursday, is geared toward executives for

multinational corporations in emerging markets, but the picks offer a

good glimpse of what emerging-market investors should look out for. That’s particularly important following a rough year for emerging

markets. The iShares MSCI Emerging Markets Exchange-Traded Fund

EEM has lost 6.7% year to date after a 19% gain in 2012.

http://tinyurl.com/kxpscjc

http://tinyurl.com/kxpscjc

Wednesday, December 18, 2013

Mr. Bernanke's Emerging Market Curse

The MSCI Emerging Markets Index,

the benchmark for investors interested in emerging

markets, has been underperforming the S&P 500 for three years. I am

sorry to say emerging markets seem destined to continue underperforming

in 2014 in part due to the pending unwind of QE and its repercussions. I stared at the relative chart

of the iShares MSCI Emerging Markets Index

fund

EEM

-0.42% almost with disbelief. On a relative basis, things are as bad for

emerging-market investors as they were five years go near the infamous

low in global markets in March 2009. EEM has rallied off that low, but

the S&P 500 has rallied so much more that it is easy to see how

investors interested in global markets can get disheartened.

The MSCI Emerging Markets Index,

the benchmark for investors interested in emerging

markets, has been underperforming the S&P 500 for three years. I am

sorry to say emerging markets seem destined to continue underperforming

in 2014 in part due to the pending unwind of QE and its repercussions. I stared at the relative chart

of the iShares MSCI Emerging Markets Index

fund

EEM

-0.42% almost with disbelief. On a relative basis, things are as bad for

emerging-market investors as they were five years go near the infamous

low in global markets in March 2009. EEM has rallied off that low, but

the S&P 500 has rallied so much more that it is easy to see how

investors interested in global markets can get disheartened.

http://tinyurl.com/m7zq55y

Tuesday, December 17, 2013

Can Companies Win By Investing in Emerging Markets?

Over the past year, there has been quite a bit of commentary about the lack of value in emerging markets. Criticisms that apply across industries -- from P&G to Facebook -- argue that companies that are banking their growth on their "next billion" consumers are entering a not-so-lucrative space. Before the Twitter IPO last month, many argued that there was little value in 77% of the company's users living outside the United States.

Monday, December 16, 2013

Nokia’s Still Strong in Emerging Markets

Nokia’s Lumia range is showing signs of promise across Europe and the US, but it is often thought that the Finnish firm is losing out on emerging market customers to cheap Android smartphones. A new survey from Jana suggests that this may not be the case, and posits the Nokia brand as (still) aspirational to many.Jana, which covers mobile rewards, marketing and research, regularly runs surveys among 2,500 selected phone owners in emerging markets in Asia. While that’s not a wide survey base, the quality of Jana’s reports is much respected.

http://tinyurl.com/nujruor

http://tinyurl.com/nujruor

Friday, December 13, 2013

How to View Emerging Markets Now

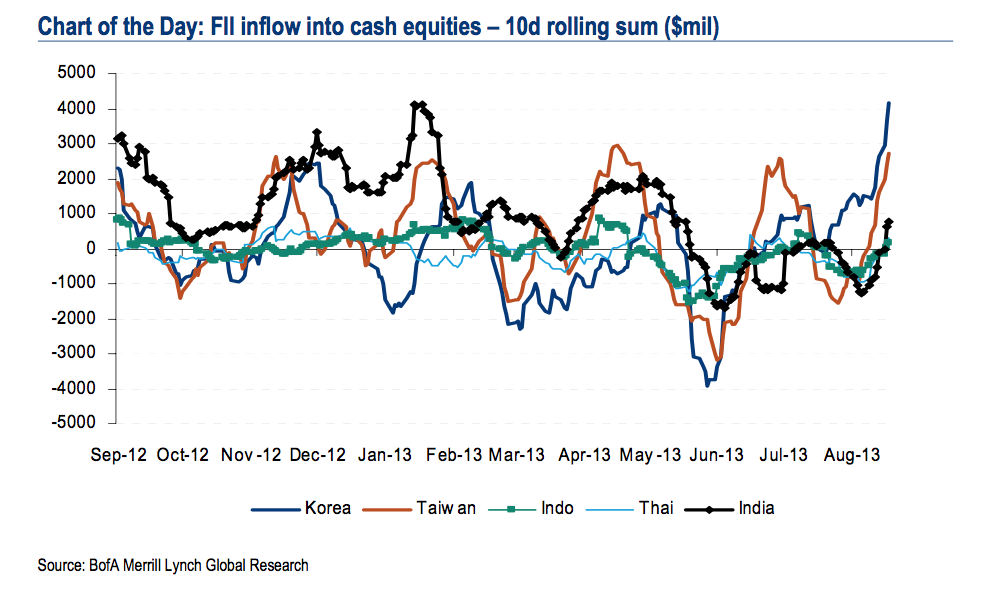

This year marked a huge switch in how some investors viewed emerging markets. In the early days of 2013 there were large net inflows, in the range of $10 billion. Almost immediately (still in January) the flows started to slow down and by May money started pouring out of companies associated with emerging markets. This happened for a variety of reasons but chief among those were investors’ fears that “easy money” being borrowed at little interest was drying up.

http://tinyurl.com/nralkmp

http://tinyurl.com/nralkmp

Thursday, December 12, 2013

Train For Startup Life; Work In Emerging Markets

A startup CEO, who began her career working in countries like India, China and Mexico, claims exposure to emerging markets is good training for entrepreneurship. There are many skills you can only learning by doing. Reading books on skiing won’t help you all that much when you hit the slopes and no one ever learned to swim while staying dry. Is the same true of entrepreneurship? Is there any way to prepare for entrepreneurship besides jumping in and starting up?

http://tinyurl.com/lxnb6h6

http://tinyurl.com/lxnb6h6

Wednesday, December 11, 2013

Invest Now In Emerging Markets for 2014

The growth is in emerging markets. However, for a variety of reasons, emerging markets have lagged this year.The chart comparing SPY with iShares MSCI Emerging Markets shows that emerging markets will have to move about 30.68% to catch up with the U. S. market.The chart again brings us to mean reversion which is commonly seen in the markets. In other words, markets that have been strong become relatively weaker and markets that have been weak become relatively stronger. It is important to note that all emerging markets are not the same. I will illustrate the point below.

http://tinyurl.com/m36tz24

http://tinyurl.com/m36tz24

Tuesday, December 10, 2013

How Do You Approach Emerging Markets?

One of the most surprising data points in Morningstar's monthly

asset-flows data during the past few years has been investors' appetites

for emerging-markets equity funds.Investors typically send new dollars to categories that have notched

strong performance, not the ones that have underperformed. But

emerging-markets equity funds have bucked that trend, garnering $43

billion in new flows during the past year even as the category's 4%

average annualized return during the past three years lags nearly every

other stock-fund category.

http://tinyurl.com/oq43cd2

http://tinyurl.com/oq43cd2

Monday, December 9, 2013

Don't Make Emerging Markets Investing Blind Spot

For many U.S. investors, the thought of investing in companies from emerging markets may provoke a sense of unease. Names like China Mobile (CHL), Infosys (INFY), and OAO Gazprom (OGZD) aren't exactly household names here. Yet many U.S. investors already own emerging-markets companies like these through their mutual funds and exchange-traded funds without even realizing it.

http://tinyurl.com/q9uszlg

http://tinyurl.com/q9uszlg

Friday, December 6, 2013

Emerging Markets Mirror Euro Zone Problems

There are problems with outsourcing your monetary policy. The euro zone is the most obvious case in point. But emerging markets economies’ difficulties are surprisingly similar. Whereas euro-zone member states have handed their monetary levers to the European Central Bank, emerging market economies have handed a substantial degree of their domestic policy to the Federal Reserve. And that’s going to be a worry for them over the coming months as Fed tapertalk resurfaces.

Thursday, December 5, 2013

Don't Be Scared of Emerging Markets

If you looked back at many stories on investing in emerging markets over the past decade, you may have thought this category should not be a part of your total portfolio. Many retirees continue to think emerging markets are still too dangerous for investing. Yet what they are missing is just how many of these countries have now risen out of the emerging markets category and into what I call "growth countries." Back in 2000, the BRIC nations, Brazil, Russia, India and China, represented only 3 percent of the world's gross domestic product. By 2012, they had advanced to represent over a fifth of the world's production.

Wednesday, December 4, 2013

IBM Pushes Smarter Infrastructure Into Emerging Markets

Tuesday, December 3, 2013

Emerging Market Shares Are Poised to Recover

Emerging markets account for more than 80% of the world’s population and half of the world’s economy, yet there are huge differences between these economies. Fast-growing giants such as China and India will continue to devour resources for decades to come. Smaller economies such as Chile and several African and Middle Eastern nations provide these commodities. The tech-savvy markets of Korea and Taiwan supply the world, largely the rich parts, with Samsungs and bits for the iPhone. However, the real story in emerging markets in the future will, in our view, not be commodities or selling cheap products to Westerners who can no longer afford them.

http://tinyurl.com/n3atp7j

http://tinyurl.com/n3atp7j

Labels:

80% of the world's population,

african,

chile,

china,

emerging markets,

emerging markets shares are poised to recover,

igor purlantov,

india,

iphone,

korea,

middle eastern,

samsungs,

taiwan

Monday, December 2, 2013

Greece Joins Emerging Markets Index

Wednesday marks Greece's return to a widely tracked emerging-markets stock index after a 12-year absence, but some fund managers aren't enthused. Many investors who specialize in developing economies say they don't intend to invest in Greece's stock market the minute Greece officially becomes part of the MSCI Emerging Markets Index, to which about $1.4 trillion in portfolios are benchmarked. In June, MSCI said it would again label Greece as an emerging market. Greece had been deemed a developed market since May 2001, shortly after it adopted the euro.

http://tinyurl.com/lw2svoa

http://tinyurl.com/lw2svoa

Subscribe to:

Posts (Atom)