Most emerging-market stocks rose as China’s surprise interest-rate cut added momentum to a four-week rally in riskier assets. The zloty weakened and Polish banking stocks fell after the opposition party looked poised for an election victory. The Shanghai Composite Index climbed 0.5 percent in the first trading day after China lowered borrowing costs for the sixth time in a year and reduced lenders’ reserve requirements.

Igor Purlantov is an expert on business and politics across emerging markets. Mr. Purlantov has worked extensively in various emerging countries throughout Europe, Asia and Africa with both public and private companies as well as local governments. You can read and learn more about his work on www.igor-purlantov.net

Monday, October 26, 2015

Monday, October 19, 2015

A Good Acronym for Emerging Markets Needs a V

Rarely has there ever been an acronym more fortunate than the BRIC group. Starting in 2001, when Jim O'Neil from Goldman Sachs synthesized Brazil, Russia, India and China, followed later by South Africa, the term began appearing in economics publications and everyday language. Soon it became synonymous with emerging markets, a relentlessly growing web that threatened to undermine the industrial world's primacy.

http://tinyurl.com/o3yqzt4

Monday, October 12, 2015

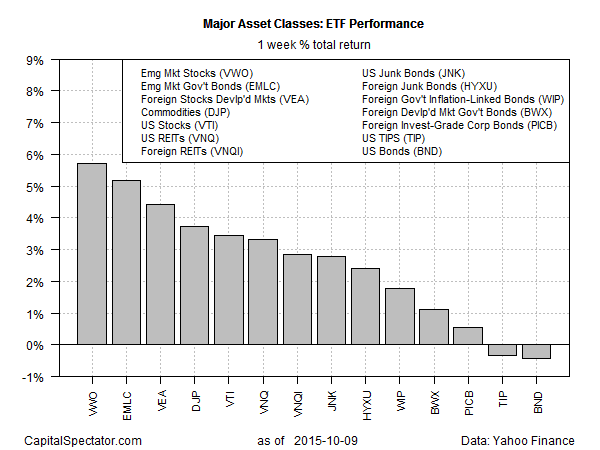

Will Last Week's Relief Rally In Emerging Markets Last?

Stocks in emerging markets posted their best weekly gain in nearly four years last week. Analysts are divided over whether this is a dead-cat bounce or the start of an enduring mean-reversion trade in the wake of nearly non-stop declines since last April. From the perspective of the week just passed, however, there's no doubt that equity markets in so-called emerging countries enjoyed a powerful rally for the five days of trading through Oct. 9.

http://tinyurl.com/obge53w

http://tinyurl.com/obge53w

Monday, October 5, 2015

New Emerging-Market Woes

One of the last havens in emerging markets is showing signs of strain. Companies in emerging markets issued trillions of dollars of foreign-currency bonds during the decade long commodity boom, and took advantage of low interest rates in the developed world following the 2008 financial crisis. Now, many investors fear the commodity bust will lead to a rise in defaults that could deepen economic slumps in many of these nations. Until a few months ago, emerging-market corporate bonds were regarded as a haven amid the routs that had hit stocks and currencies in many developing countries because the bonds are typically issued in the U.S. dollar and by companies with robust growth and credit profiles.

http://tinyurl.com/nbyls7e

Subscribe to:

Posts (Atom)