When a rescue team arrived to evacuate a closing zoo near the Gaza Strip city of Khan Younis in late August, just 15 animals remained. They included Laziz, a nine-year-old Bengal tiger that is—according to Four Paws, the Vienna-based animal-welfare nonprofit that led the rescue—the last tiger in Gaza. There were also five monkeys, an emu, a pelican, two buzzards, two porcupines, two tortoises, and a doe. The doe had lost her fawn to wounds shortly before the rescuers arrived.

Igor Purlantov is an expert on business and politics across emerging markets. Mr. Purlantov has worked extensively in various emerging countries throughout Europe, Asia and Africa with both public and private companies as well as local governments. You can read and learn more about his work on www.igor-purlantov.net

Thursday, September 29, 2016

Monday, September 19, 2016

Emerging Markets Are Climbing Back From the Dead

Stocks and bonds from Thailand, Indonesia and other developing economies are emerging from their burrow. After ranking as some of the world's worst investments the last few years, emerging markets have produced some of the best returns of 2016. Gains have been so big for Brazilian bank Banco Bradesco, Chinese technology giant Tencent and emerging-market stocks in general that the average mutual fund invested in them has returned 11.5 percent this year.

Tuesday, August 16, 2016

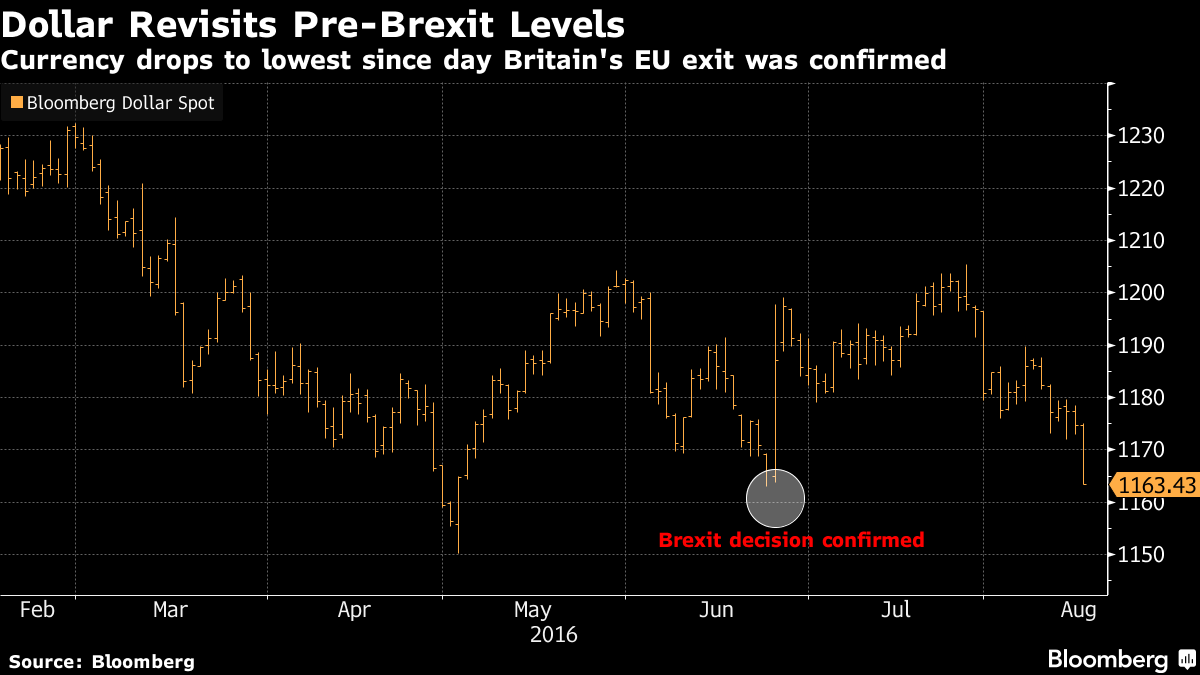

Dollar’s Decline Reverberates as Emerging Markets Rise With Gold

The dollar’s slide is gathering pace and that’s proving as much a boon for emerging markets and commodities as it is a drag for European equities. The Bloomberg Dollar Spot Index sank to its weakest since June before reports on housing starts, inflation and industrial output that may add to signs growth in the world’s largest economy is losing momentum. Emerging-market currencies reached the strongest in more than a year and stocks from those nations gained for a ninth day. The pound jumped as U.K. inflation accelerated in July more than economists predicted, and the yen strengthened through 100 per dollar. Precious metals advanced with Treasuries.

Wednesday, August 10, 2016

Emerging Markets Gaining Favor Despite China Concerns

The hunt for yield is driving investors back into emerging markets – but there are a few key differences this time round. Emerging market equities, measured by the MSCI Emerging Markets Index, are now 30 percent up from the low seen at the end of January, and have rallied by 13 percent since the post-Brexit referendum sell-off. Plus, in the past five weeks, record amounts of money have been invested in emerging market debt, according to figures from Bank of America Merrill Lynch.

http://tinyurl.com/j849xojMonday, July 18, 2016

Emerging Markets Have a Place in the Portfolio

Over the last five years, investors in emerging markets mutual funds have paid plenty and gotten little in return.

http://tinyurl.com/hr9yfsz

http://tinyurl.com/hr9yfsz

Tuesday, July 5, 2016

Emerging Markets’ Challenge to Silicon Valley

Silicon Valley leads the global technology innovation markets with the credentials and an ecosystem that is second to none. We have had contact with many of the leading technology accelerators operating out of Silicon Valley, and their opening line for the conversation is often: “How are you relevant to us?”

http://tinyurl.com/gquvrhx

http://tinyurl.com/gquvrhx

Tuesday, June 28, 2016

Brexit Effect Ripples Through Emerging Markets

Britain’s vote to leave the European Union continued to hurt emerging markets on Monday, sending currencies and stocks falling from Mexico to Poland as investors fled riskier assets. The declines highlight how Brexit is causing ripple effects across the world, raising uncertainty about global growth and pushing investors into assets they see as safe, such as the U.S. dollar. The dollar’s gains then feed back into concerns about emerging markets, making their greenback-denominated debt and the commodities they sell more expensive.

Monday, June 20, 2016

India Outshines Emerging Markets

Since Raghuram Rajan took over as RBI governor on September 4, 2013, Indian equities have been the best performer among all emerging markets.

http://tinyurl.com/hnxoqer

http://tinyurl.com/hnxoqer

Monday, June 13, 2016

Emerging Markets Led Overall Market Performance

Global equity markets, represented by the MSCI AC World Index, closed with a gain of 0.62 per cent for the week ended June 3, 2016. As a whole, emerging markets outperformed developed markets as the MSCI Emerging Markets and the MSCI Asia ex Japan indices closed with larger gains of 1.37 per cent and 1.28 per cent respectively. Among developed markets, Japan emerged as the best performer, with the Nikkei 225 index closing 2.21 per cent higher. The US, represented by the S&P 500 Index, registered a gain of 0.39 per cent while the Stoxx 600 Index ended the week 0.34 per cent lower.

http://tinyurl.com/zt4j92zWednesday, June 8, 2016

What Is an Emerging Market?

In April this year, the World Bank released its 2016 edition of World Development Indicators, and for the first time, it stopped classifying countries as "developing" and "developed." According to the organization, the distinction was no longer relevant, as it aims to use a set of sustainable development goals that can be applied to all countries.

http://tinyurl.com/jk9kthh

http://tinyurl.com/jk9kthh

Tuesday, May 31, 2016

Citigroup Says Saudi Is Best Emerging Market for Deals

Saudi Arabia’s planned privatizations, including a share sale in the world’s biggest oil company, represent the biggest investment banking opportunity in emerging markets, according to Citigroup Inc. Implementation of the kingdom’s plans to restructure the economy -- known as Vision 2030 -- "could translate into a fantastic wallet for the investment banks," Omar Iqtidar, Citigroup’s head of investment banking in the Middle East, said in an interview in Dubai. "We are seeing momentum picking up, with skeptics increasingly converted into believers of the restructuring," he said.

http://tinyurl.com/zy2z5qt

Monday, May 23, 2016

Fledging Emerging Market Reprieve Ends as Fed Hawks Take Wing

The brief reprieve in emerging markets is over, cancelled out by a sharp reminder from the US that nobody should be betting on low rates to last for ever. As markets absorbed the US Federal Reserve’s April meeting minutes published last week and realised that a summer rate rise was back on the table, a “risk-off” trade took hold that pushed the dollar up and sent commodity and equity prices down.

Monday, May 9, 2016

Is Now the Time to Buy Emerging Markets?

Andrew Swan, head of Asian equities and portfolio manager at BlackRock Asset Management, discusses emerging markets, currencies in Asia and his outlook for China. He speaks to Bloomberg's Yvonne Man on "Asia Edge."

Monday, May 2, 2016

Emerging Markets Says Oil Prices to Rebound to $60

The emerging-market investment pioneer Mark Mobius said he expects oil prices to rebound to US$60 a barrel by the end of the year as the supply of crude shrinks, giving a measure of relief to major oil producers like the UAE and other Arabian Gulf nations. Oil prices have shot up by almost 20 per cent in the last three months since declining by as much as 70 per cent since mid-2014.

Monday, April 25, 2016

Re-Emerging Markets

Last Wednesday, I was fielding questions from a couple of CNBC reporters on the trading floor of the New York Stock Exchange. One thing they asked me about was emerging markets, which was great as it allowed me to talk about our Multi-Asset Class team's views on these important regions. It also reminded me of how little space we've given the subject in CIO Perspectives so far.

http://tinyurl.com/j3989sh

http://tinyurl.com/j3989sh

Monday, April 18, 2016

Emerging Markets Get Surprise Lift

A wave of interest-rate cuts by emerging-market countries is helping extend a sharp rally in their stock and bond markets, delivering investors returns that few had forecast heading into 2016. During the past month, central banks in India, Indonesia, Turkey, Hungary and Taiwan have lowered rates in a bid to counter soft economic growth. Analysts say more developing nations may follow in coming months, likely adding fuel to a two-month-long surge that has taken the MSCI Emerging Markets stock index up 6.6% for the year, reversing a double-digit decline. The S&P 500 is up 1.8%.

Monday, April 11, 2016

Looking for Signs of Life in Emerging Markets

For years, many investors have been pining for a rebound in emerging-market stocks, only to be frustrated by the slide in commodity prices, which still drive many developing economies. The situation appeared to improve in the first quarter.

Monday, April 4, 2016

Are Emerging Markets Stabilizing?

Enzio Von Pfeil, investment strategist at Private Capital, discusses the outlook for emerging markets and China's property market. He speaks to Bloomberg's Angie Lau and Rishaad Salamat on "Asia Ed

http://tinyurl.com/zx2bgex

http://tinyurl.com/zx2bgex

Monday, March 28, 2016

Springtime in Emerging Markets

Research Team at Danske Bank, suggests that one of the most striking features so far of 2016 has been the relative strength of Emerging Market (EM) currencies which has happened over a period when other risky assets generally plummeted.

http://tinyurl.com/hsnyqew

http://tinyurl.com/hsnyqew

Wednesday, March 23, 2016

Santam to Target Emerging Markets

Short term insurer Santam said its medium-term strategy was to expand into Asia and the rest of Africa through its partnership with Sanlam Emerging Markets. The group will also expand using its reinsurance unit Santam Re and Santam Specialist, which offers among other things, aviation, marine, and transport insurance. This comes as it finds limited acquisitive growth opportunities in SA due to its dominant position.

Monday, March 14, 2016

Emerging Market Stocks at Three Month Highs

Egypt's currency fell almost 15 percent versus the dollar on Monday after a long-awaited devaluation and Cairo stocks jumped 6 percent, while broader emerging stocks extended gains to hit three-month highs. Egypt's central bank said it was adopting a more flexible exchange rate policy, devaluing the pound to 8.85 per dollar in a move that follows the lifting of some currency restrictions last week.

Monday, March 7, 2016

Is It Time to Make Up With Emerging Markets?

The best time to take a vacation can be off-season. There aren’t big crowds of tourists and prices tend be cheaper. The same may be true for investing in emerging markets in 2016.

http://tinyurl.com/jgbpbo3

Monday, February 29, 2016

Argentina Is the Next Big Opportunity for Emerging Markets Investors

Although it is known for the tango, Argentina is familiar with another dance: the limbo. Money managers have watched as the country has descended lower and lower in terms of its stature as an investment location. But that may be changing. After a decade of failed economic policies, recessions, high inflation and defaults, Argentina's new president, Mauricio Macri, is remaking the country with bold strokes so that it is more investor-friendly.

Monday, February 15, 2016

Should You Invest in Emerging Markets Today?

In "What Market Experts Are Saying About Future Returns", Morningstar director of personal finance Christine Benz summarized long-run market forecasts from a range of well-respected experts. Most experts painted a dull picture for U.S. stock and bond market returns over the next several years. A few--including the research teams at GMO and Research Affiliates--expect emerging markets to be a bright spot.

http://tinyurl.com/zgoxh55

Monday, February 8, 2016

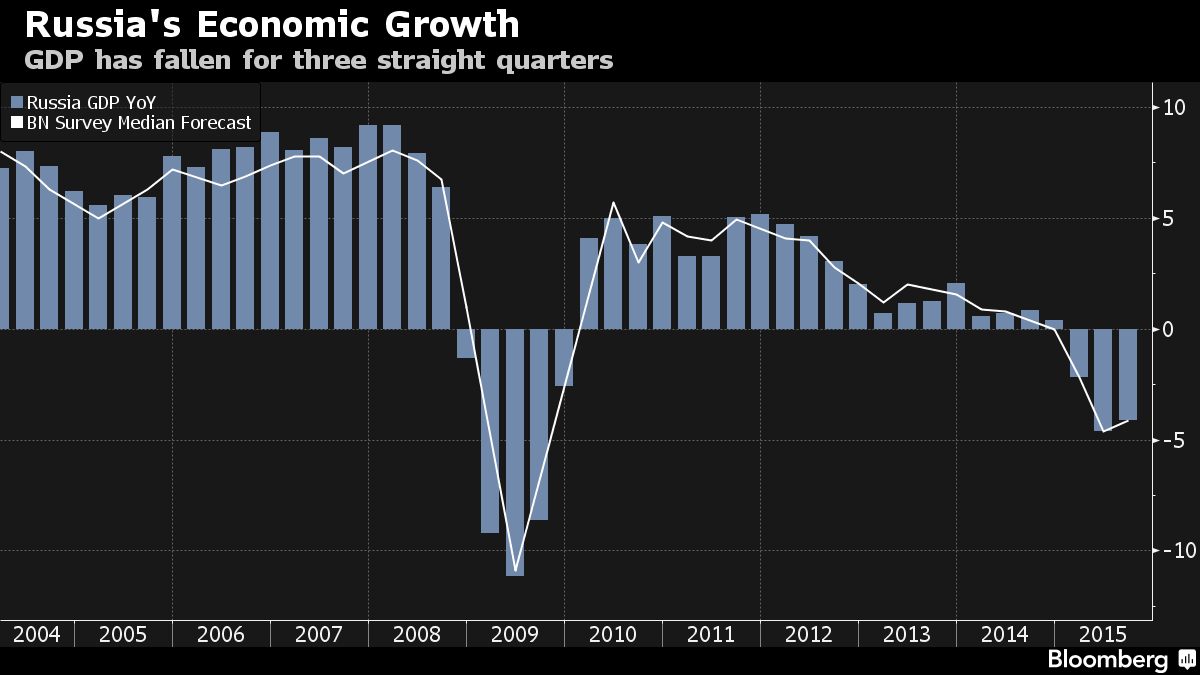

Russia Will Give Emerging Market Growth a Boost

Growth in emerging-market economies is getting a bit of a tailwind this year from a surprising source: Russia. While Russia will still be in recession in 2016, the pace of the contraction in its gross domestic product will slow to 0.5 percent from 3.7 percent, according to Alberto Ades, head of global economic research at Bank of America Corp. That will be less of a drag on overall growth in developing nations, which he sees expanding 4.2 percent, after 4 percent growth in 2015.

Monday, February 1, 2016

The Riskiest Emerging Markets

Investors worried about emerging markets face a vexing question: Which countries are actually the riskiest? By one measure -- corporate leverage -- Brazil and India stand out, though for China and Turkey the answer depends on how you look at it.

http://tinyurl.com/jjfmw82

http://tinyurl.com/jjfmw82

Monday, January 25, 2016

Why Money Has Suddenly Started Flowing Out of Emerging Markets

In the latest weird economic news, something is happening in international capital flows that we haven't seen since the late 1980s. Emerging markets, which have seen money flowing into their economies for years, suddenly saw those flows reverse — and reverse massively — in 2015. On net, $111 billion flowed out of the emerging markets in 2014. But the latest numbers from the Institute for International Finance peg the outflow in 2015 at a whopping $735 billion.

http://tinyurl.com/hp8byk3

http://tinyurl.com/hp8byk3

Monday, January 18, 2016

Have the BRICs Hit a Wall? The Next Emerging Markets

Which countries are poised to become the next high-growth developing markets? Until recently, when people talked about “emerging markets,” they were referring to the BRIC economies: Brazil, Russia, India and China. Undeniably, these countries have changed the face of global business over the past 20 years. Yet lately, the BRICs have been crumbling a bit, sparking many reports about their lackluster performance.

Labels:

20 years,

brazil,

bric,

china,

countries,

emerging markets,

have the brics hit a wall,

high growth,

igor p purlantov,

india,

performance,

reports,

russia,

the next emerging markets

Monday, January 11, 2016

India Has Defied the Emerging Market Slump

You know a country has it good when the worst news to emerge in the last year is a warning that economic growth could slow — to 7 percent. Such is the situation in India, which is enjoying a remarkable combination of good luck and fundamental strengths that include a popular prime minister in the form of recently elected Narendra Modi, a growing consumer market and its emerging market cohorts in Brazil, Russia and China (BRICs) faltering in a way that has unsettled investors around the globe.

Monday, January 4, 2016

Is It Time to Get Back Into Emerging Markets?

Mark Matthews, head of Asian research at Bank Julius Baer, discusses Asian markets, China's latest PMI figures and where he sees opportunity. He speaks to Bloomberg's Haidi Lun on "First Up."

http://tinyurl.com/jv67co2

http://tinyurl.com/jv67co2

Friday, January 1, 2016

3 Reasons Emerging Markets Set to Rebound in 2016

China's slowdown, a commodity crash, corrupt governments, ISIS threats, the strong dollar, a Fed rate hike... the list goes on. It was the worst year for developing economies -- such as Mexico and Turkey -- since the global financial crisis in 2009. But after five years of declining growth, it appears this broad group of countries has hit

bottom and will start to make a comeback next year.

Subscribe to:

Posts (Atom)